Welcome to the digital era, where banks dive headfirst into email marketing. The quality of your email marketing strategy could very well be the deciding factor in your bank’s lead acquisition and retention.

Email marketing saves banks time and energy while simultaneously improving the ROI of their marketing efforts.

In this all-encompassing guide, we’ll explore the importance of email marketing for banks, the strategies that work, the types of campaigns to unleash, the critical aspect of deliverability, and best practices to keep your bank ahead. Let’s dive in!

Importance Of Email Marketing For Banks: Stats and Benefits

So, why does email marketing deserve your attention? Because email marketing is one of the top strategies for banks and financial institutions to capture and retain customers.

Take a look at these stats gathered between 2022 and 2023:

- Email marketing generates an average ROI of $36 to $42 per $1 spent, making it one of the most effective marketing strategies.

- Email marketing will become the top marketing channel, boasting an impressive open rate of 37.65%.

- In 2022, financial services emails had an open rate of 27.1% and a CTR of 2.4%. High-performing financial service providers were converting up to 23%, but the average conversion rate was 4.3%.

- In 2023, the open rate is now 41.44%, with a CTR of 4.9%.

According to a survey by Statista, 60% of consumers in the United States prefer to receive updates from companies via email, highlighting the effectiveness of this channel. Clearly, email marketing is a highly effective strategy that your bank would benefit from fully implementing.

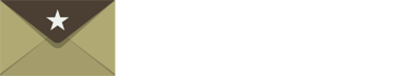

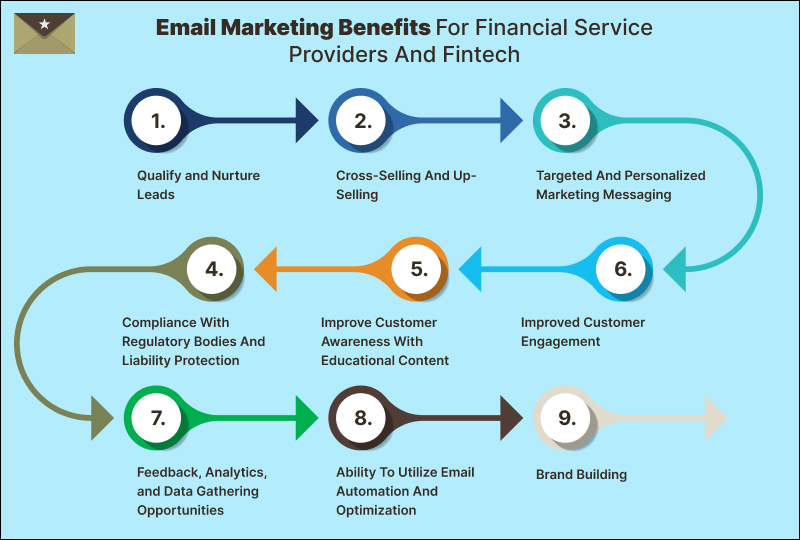

Benefits Of Email Marketing for Banks

Email marketing provides a diverse range of benefits.

Take a look at some of the top benefits:

Cost efficiency

Email marketing is the most cost-efficient marketing strategy for businesses of all sorts.

Reduced Human Resources Costs

Email marketing enables your marketing team to automate personalized emails and communicate more efficiently with potential leads and current customers.

Better Personalization

Personalized marketing messages perform better than generic messaging. Email marketing lets your bank personalize each email to the specific recipients’ needs, desires, and behaviors.

Thorough Lead Nurturing And Reputation Management

Effective lead nurturing and reputation management are paramount for banks. Reputation is pivotal, influencing the decisions of leads entrusting their finances. A pristine reputation positions your bank as the top choice. Email marketing is instrumental in building and sustaining trust. Delivering informative content empowers leads to make confident decisions.

Best Practices And Tips For Email Marketing For Banks

Consider these best practices when you write your next email:

Ensure Compliance with Regulations

Stay updated on financial regulations and ensure your email campaigns comply with relevant laws, such as CAN-SPAM or GDPR. Non-compliance can lead to severe consequences and damage your reputation.

Create and Maintain a Consistent Content Calendar

Establish a consistent email marketing calendar. This helps maintain regular communication without overwhelming your subscribers and allows for strategic planning of campaigns.

Prioritize Security and Trust

Ensure your emails highlight your bank’s security efforts and build trust. Your customers want to know you have their back and actively protect their money and financial goals. As you update and improve your security, inform your subscribers of these improvements.

Use Targeted Product and Service Recommendations

Leverage data analytics to provide personalized product or service recommendations based on a customer’s transaction history and preferences. Automation will be your best friend here!

Share personalized service and product recommendations with each subscriber when they show interest. This targeted approach can significantly increase the relevance of your emails.

Encourage Customer Feedback and Iterate As Needed

Create a feedback loop by encouraging customers to share their thoughts and opinions. Use surveys or feedback forms to gather insights to guide your email marketing strategy and address customer needs.

Implement changes quickly when you identify an opportunity to improve your services, security, or customer experience. Once you make improvements, use this opportunity to strengthen customer trust by informing your customers of the adjustments and how they will benefit them.

Consider Sustainability

Individuals worldwide are becoming more concerned with a business’s sustainability initiatives. Showcase your bank’s commitment to sustainability and corporate social responsibility. Highlight initiatives like paperless statements or eco-friendly practices to appeal to environmentally conscious customers.

Email Deliverability For Banks

Email deliverability for banks is the unsung hero in the symphony of successful email marketing. It ensures your carefully crafted emails reach the right inbox at the right time.

The spam folder is the adversary here; no bank wants to be forgotten in the crowded spam folder. Maintaining a high level of deliverability means avoiding any spam triggers. Follow these tips to ensure email deliverability:

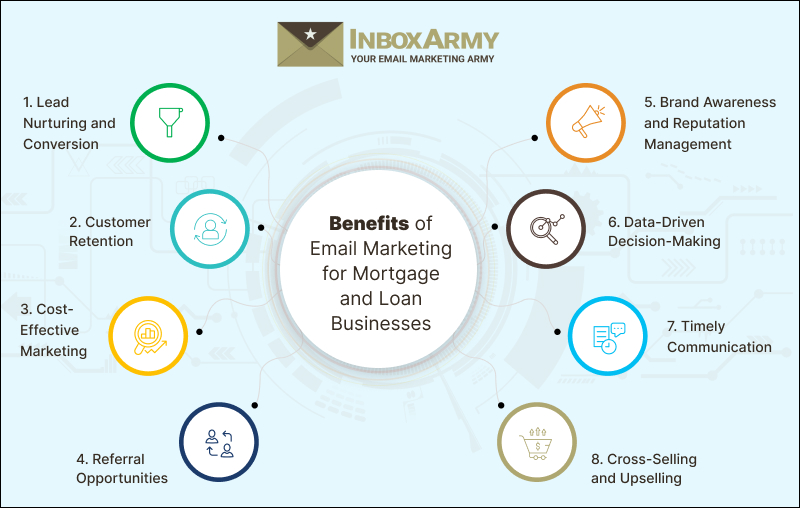

Build and Maintain a Quality Email List

Ensure that your email list consists of engaged and opted-in subscribers. Avoid purchasing or renting email lists, which can lead to many spam complaints and negatively impact your deliverability.

Regularly clean your email list by removing inactive or bounced email addresses. High bounce rates and inactive users can signal to internet service providers (ISPs) that your emails are unwanted, affecting your sender’s reputation.

Use Double Opt-In

Implement a double opt-in process to confirm subscribers’ intentions and reduce the likelihood of fake or mistyped email addresses entering your list. This adds an extra layer of authentication, contributing to improved deliverability.

Segment Your Email List

Segment your email list based on user behavior, demographics, or engagement history. Sending targeted and relevant content to specific segments enhances user experience and reduces the chances of your emails being marked as spam.

Craft Clear and Compelling Subject Lines

Write email subject lines that accurately reflect the content of your emails, and avoid using spammy phrases or excessive punctuation. Clear subject lines not only improve user engagement but also help in bypassing spam filters.

Authenticate Your Emails

Use email authentication protocols like SPF (Sender Policy Framework) and DKIM (DomainKeys Identified Mail). These technologies verify that your emails legitimately come from your domain, boosting your credibility with ISPs.

Monitor and Analyze Engagement Metrics

Monitor email engagement metrics such as open, click-through, and unsubscribe rates. Analyzing these metrics can help you identify issues early and adjust your email strategy.

Provide Clear Opt-Out Options

Make it easy for subscribers to opt out of your emails by including a visible and accessible unsubscribe link. This not only complies with regulations like CAN-SPAM but also reduces the likelihood of your emails being marked as spam.

Avoid Using URL Shorteners

URL shorteners are often associated with spam, and some ISPs may view them suspiciously. Use complete, clear URLs to link to your content whenever possible and avoid any unnecessary red flags.

Test Your Emails Before Sending

Before launching your email campaign, conduct tests using spam filters and email deliverability tools. This allows you to identify and rectify potential issues that might impact your deliverability and ensures your emails land where they’re intended—in the inbox.

Achieving good email deliverability is an ongoing process that requires vigilance, adherence to best practices, and a commitment to providing value to your subscribers.

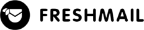

What Kind Of Email Strategy Is Best For Banks?

Now let’s let’s talk strategy. Your email marketing strategy is the foundation for every single email you send. Skip this step, and you might as well give up on email marketing altogether because you won’t see the results other banks attain with a solid strategy. With that said, let’s see the strategies you need to include in your email marketing efforts.

Segmentation is Your BFF

Certain emails, like your welcome emails, policy changes, and announcements, will be sent to all your subscribers. But don’t send the same email to all your customers regarding regular marketing emails.

According to a report by Campaign Monitor, segmented email campaigns have a 14.31% higher open rate than non-segmented ones. Break down your customer base into groups based on demographics, behaviors, or preferences. This way, you can send personalized messages that resonate.

Automation: Your 24/7 365 Assistant

Roughly 49% of businesses currently utilize some form of automation, with 75% of email revenue generated from trigger campaigns, including welcome and abandoned carts emails. Automation is highly efficient and takes care of simple personalizations and trigger emails so you don’t have to.

Set up automated campaigns to onboard new customers, send transactional messages, or nudge inactive account holders. The behind-the-scenes automation keeps your customers engaged without wasting extra time and energy. Automation can also help you with the next strategy: personalization.

Personalization

Remembering a customer’s name is great, but remembering their preferences will garner next-level results. Personalization isn’t just about slapping a name on an email; it’s about tailoring content based on what your customer likes.

To personalize your subscriber’s email, you must know their goals, interests, demographics, and current financial situation. Some information can be collected when they subscribe, but the nitty gritty will take time. Analytics can track subscribers’ interests; surveys can collect other data points. Consider using free resources and educational content to collect subscriber information.

Once you have this information, use your analytics and customer data to create unique emails tailored to each subscriber’s recent interests and ever-changing needs.

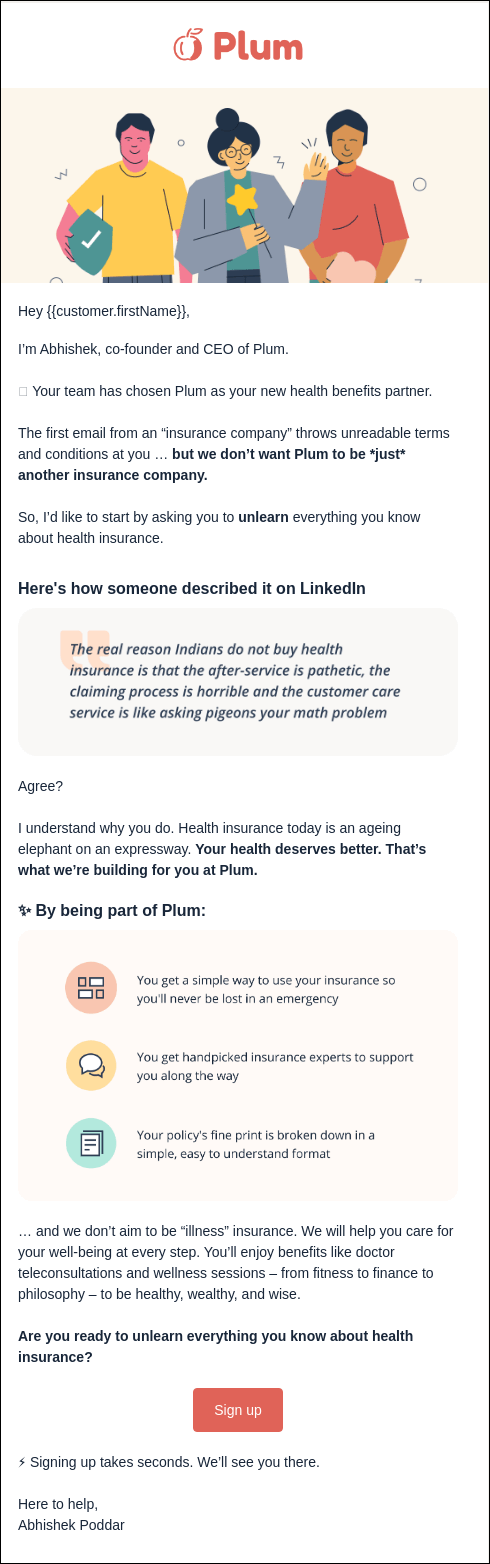

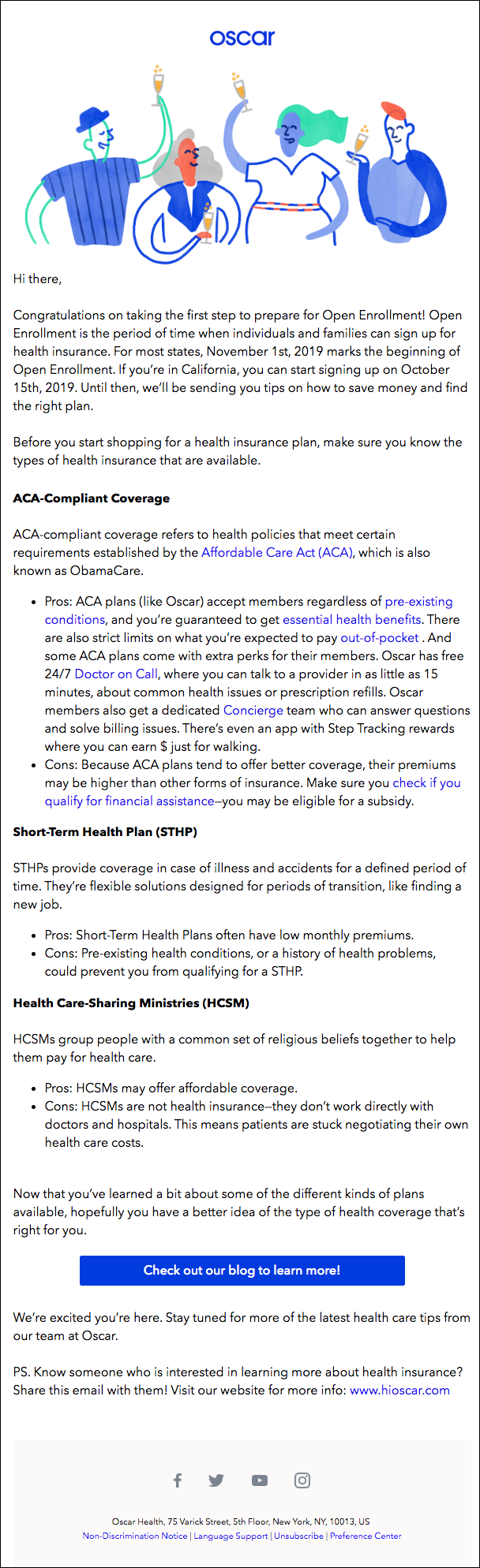

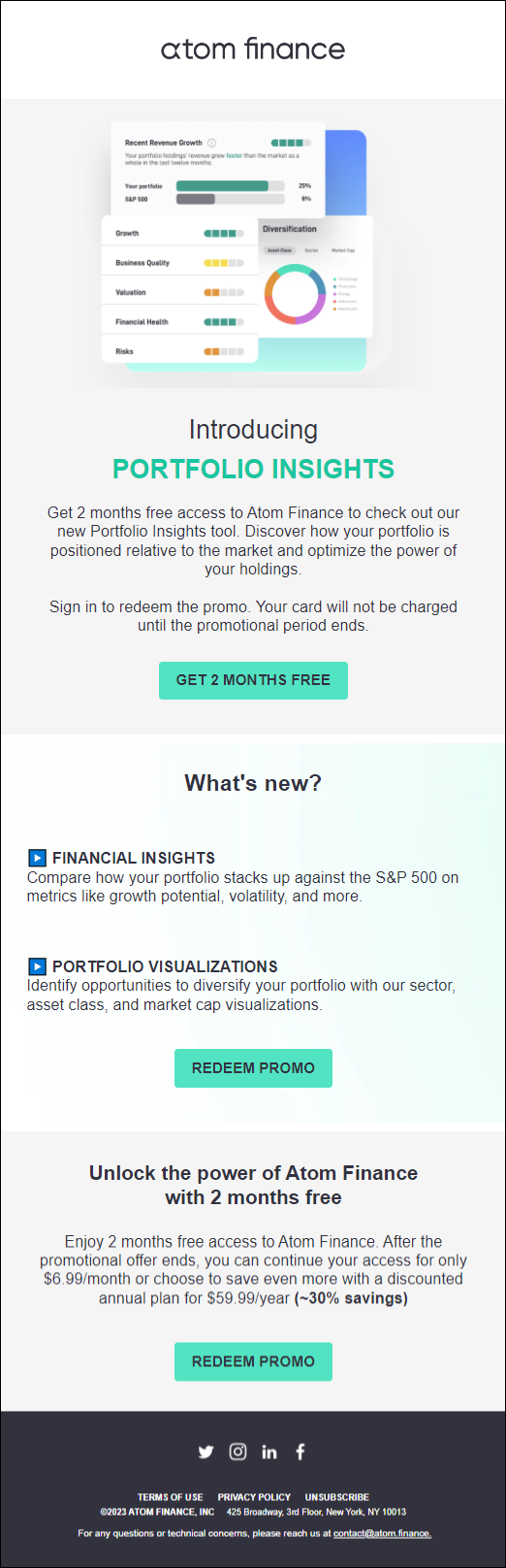

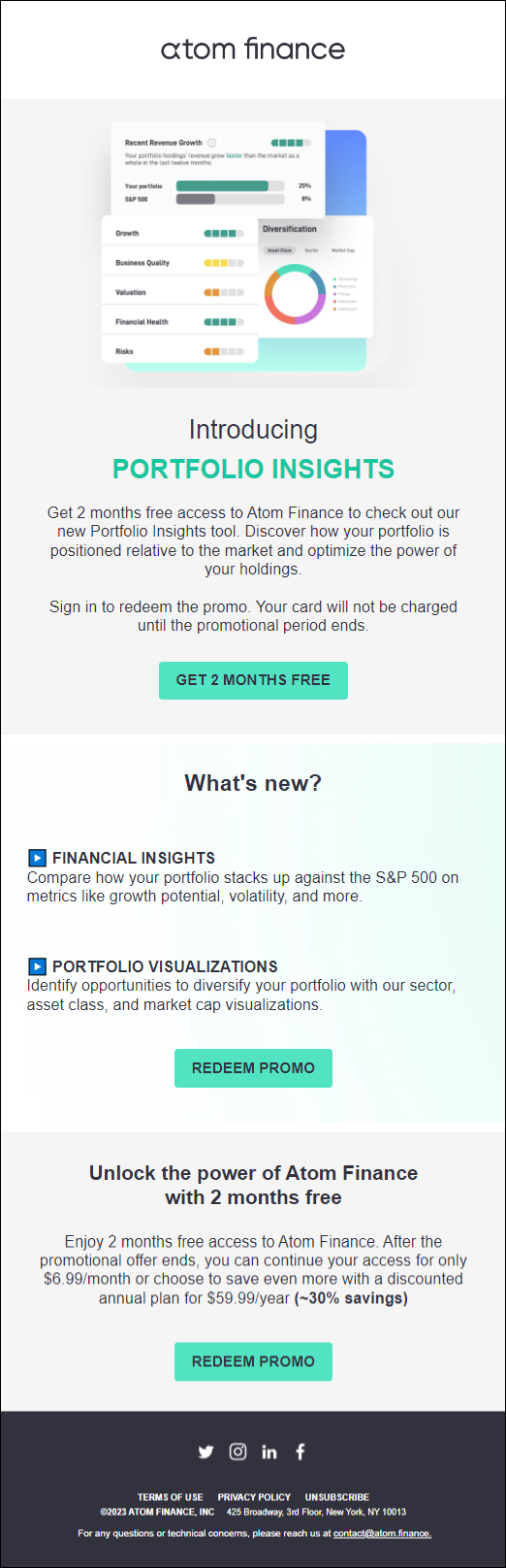

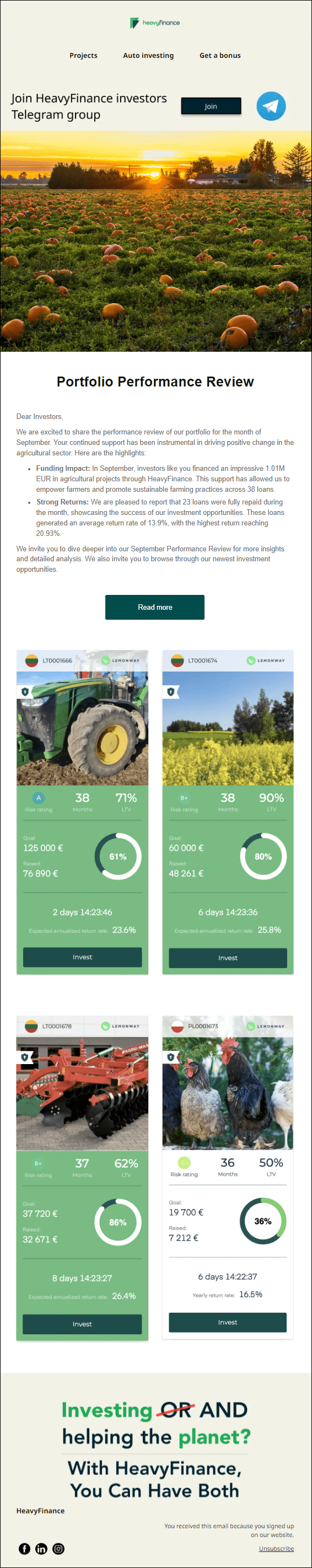

Email Marketing Campaign Examples For Banks

So, what does an email marketing strategy for a bank look like in real life? Take a look at these examples:

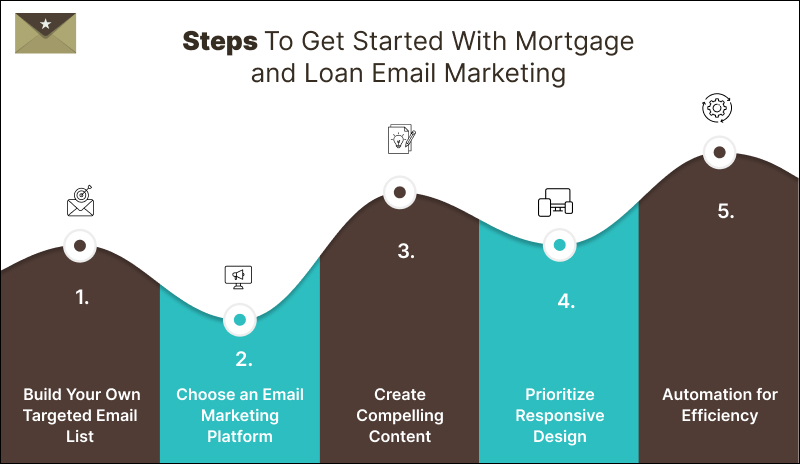

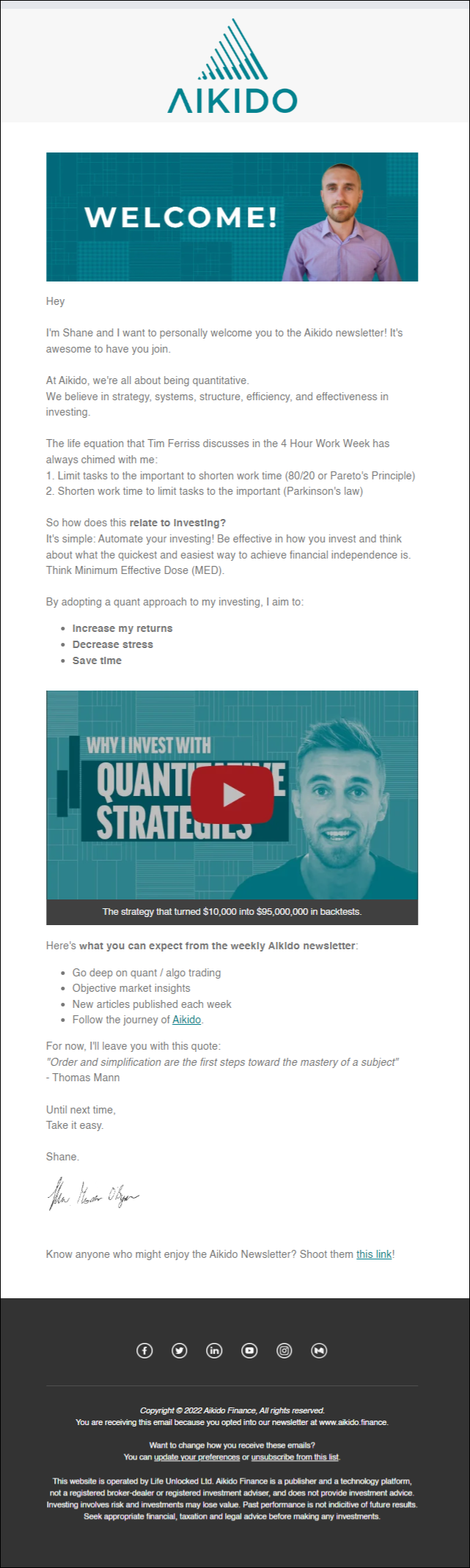

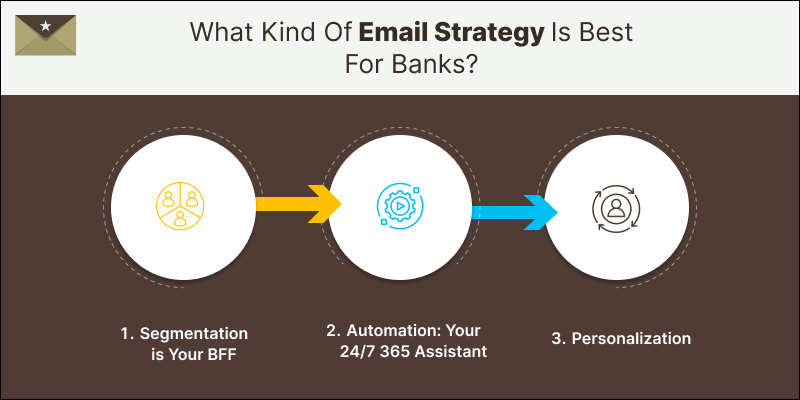

Account Creation

This would be a trigger email sent when an individual sets up an online or in-person account at a local branch. Take a look at this example from Greenlight. Bank Of America also has a good example.

Transactional Messages

This would be another trigger email that can be handled using automation. This email would automatically be sent to the sender and possibly the receiver when a transfer or transaction is initiated or received. Take a look at this example from Venmo.

Money Withdrawal

Most of us have seen the withdrawal notification through email or text. This standard email is triggered when a user withdraws funds from their account. While this email may seem simple, it goes a long way to improve security and put users at ease.

Up-Sell

Up-selling encourages customers to spend more to access more value for their money. When a customer is interested in a product or service, share an email with the next “step up” option. Take a look at Venmo’s example.

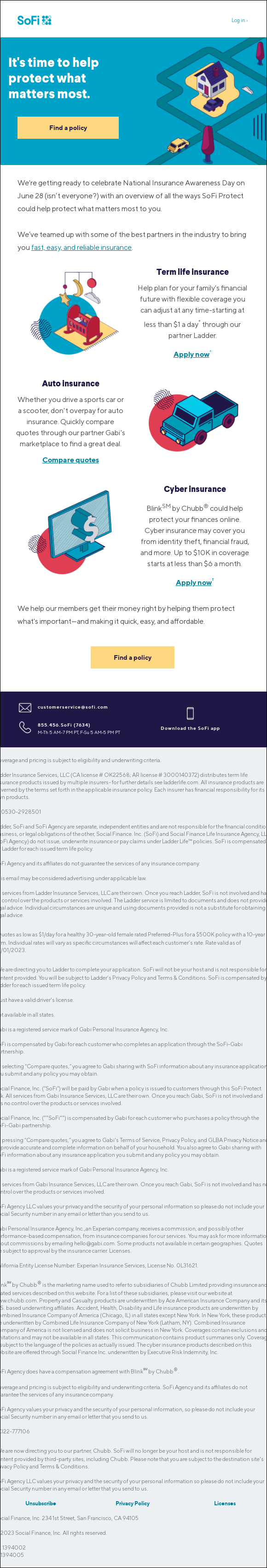

Cross-Sell

Croll selling also improves your CLV. When a customer purchases a product or service share related products and services, this strategy aims to boost your sales and works well because your customers already know and trust you. They have already made a purchase and can be more easily persuaded to make another. Take a look at this email example from Venmo.

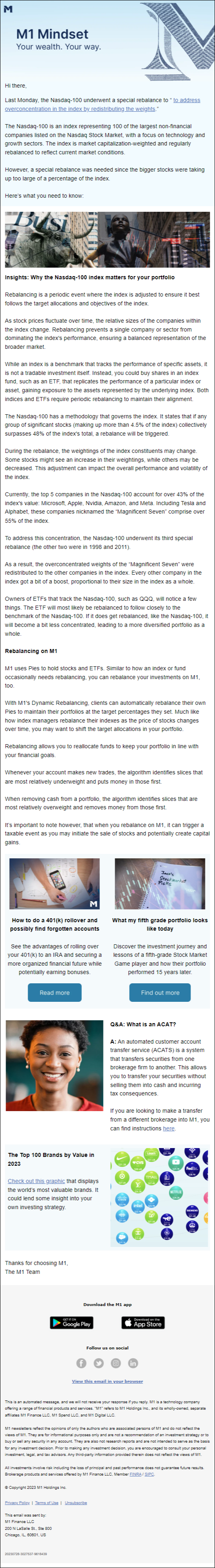

Informational

Information and education are readily available online. Customer wants to improve their financial literacy like never before. And the individual or business that helps them improve their literacy becomes a trusted advisor.

You want to be that trusted business. Regularly share valuable and actionable information so customers become accustomed to trusting you for financial advice and, eventually–their money. Take a look at this example from Wealthsimple.

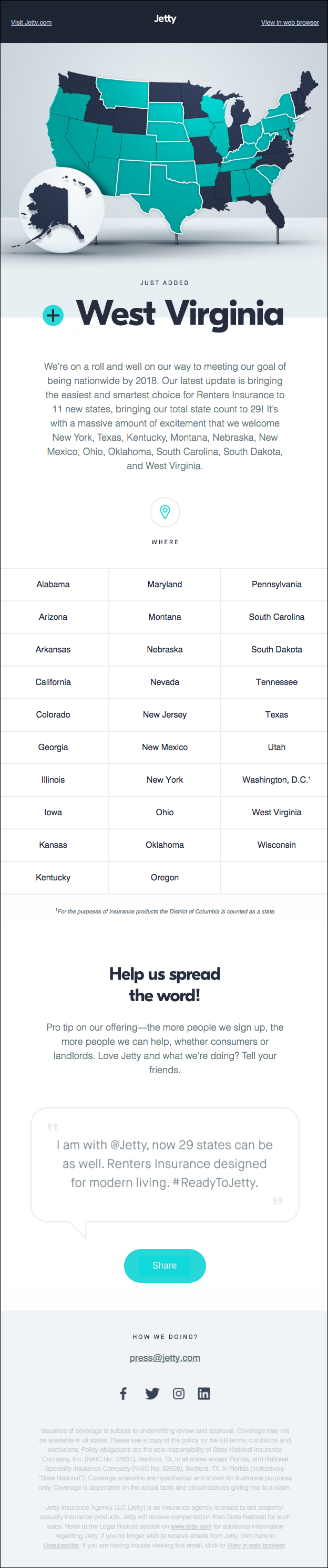

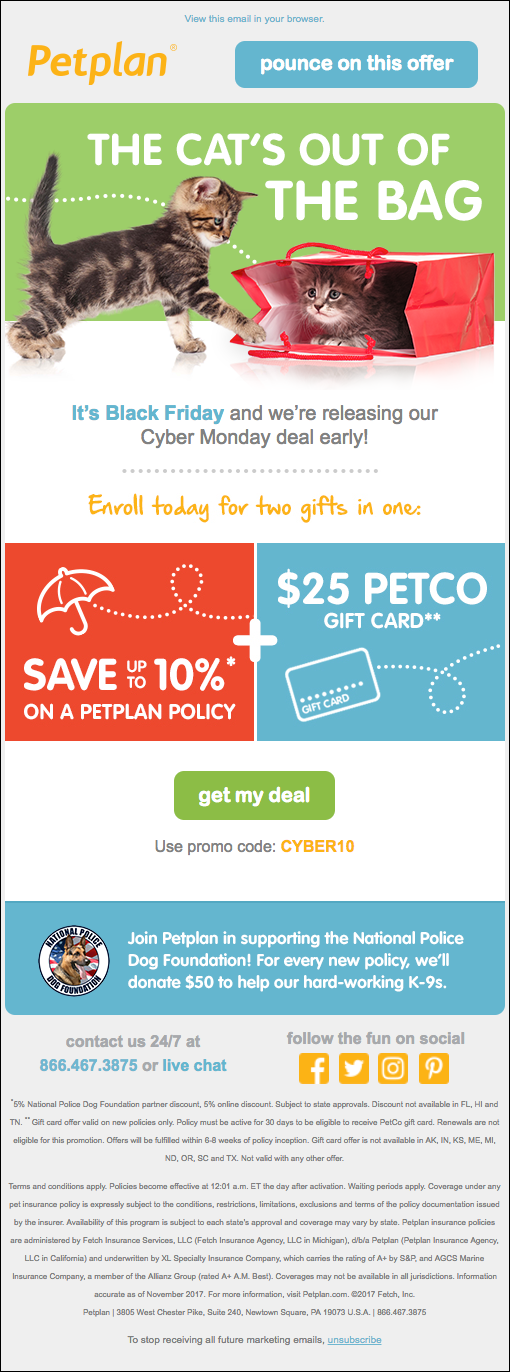

Promotional

Use holidays, sales, and special deals to promote your services or products. Here is an example of Yoco’s B2B promotional email.

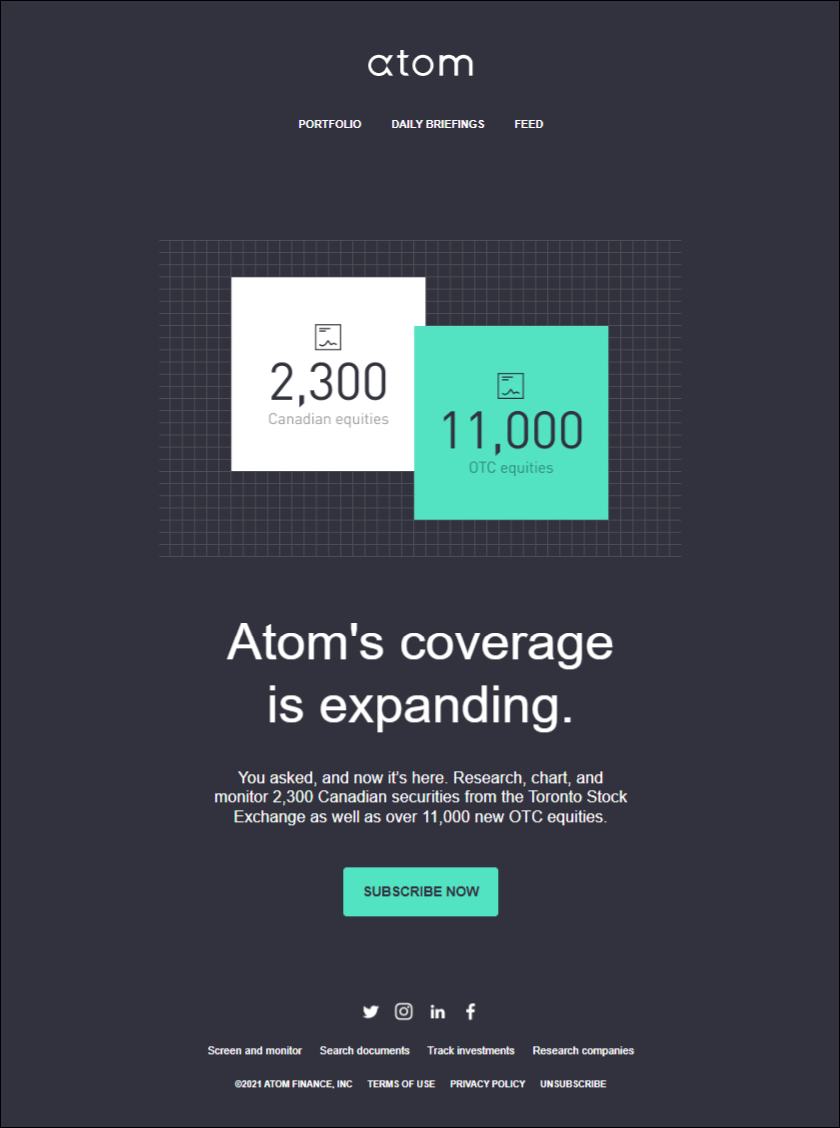

Improved Services and Features

This email campaign builds trust with your customers and is top-of-mind. Share new features, service, or product that provides value with your subscribers. Simple has a great email showcasing improvements and new features.

Takeaway

Mastering email marketing is not just an option; it’s a crucial determinant for lead acquisition and retention. The efficiency and ROI boost offered by email marketing make it an indispensable strategy for financial institutions.

To begin email marketing or improve your current strategy, utilize the best practices and information in this article. A few simple changes can go a long way.

If you want to go further, consider working with an email marketing partner. At InboxArmy, we develop and deploy email marketing strategies that grow your subscribers, leads, and conversions or Contact InboxArmy an email agency to learn how our solutions can help you!